Monica Yang, Ph.D., is delving behind the headlines to figure out what motivates businesses in China and other developing countries to buy companies in other countries.

Looking at the news about Chinese companies buying Canadian energy firm Nexgen and U.S. pork producer Smithfield Foods, you might get the impression that the Central Kingdom is on a quest for worldwide domination. Monica Yang, Ph.D., an associate professor at the Robert B. Willumstad School of Business, is delving behind the headlines to figure out what motivates businesses in China and other developing countries to buy companies in other countries.

“This is something people are interested to know: why are they coming, what do they want, are they successful?” Dr. Yang says. “Their motivation differs from what we know about companies in the developed markets.”

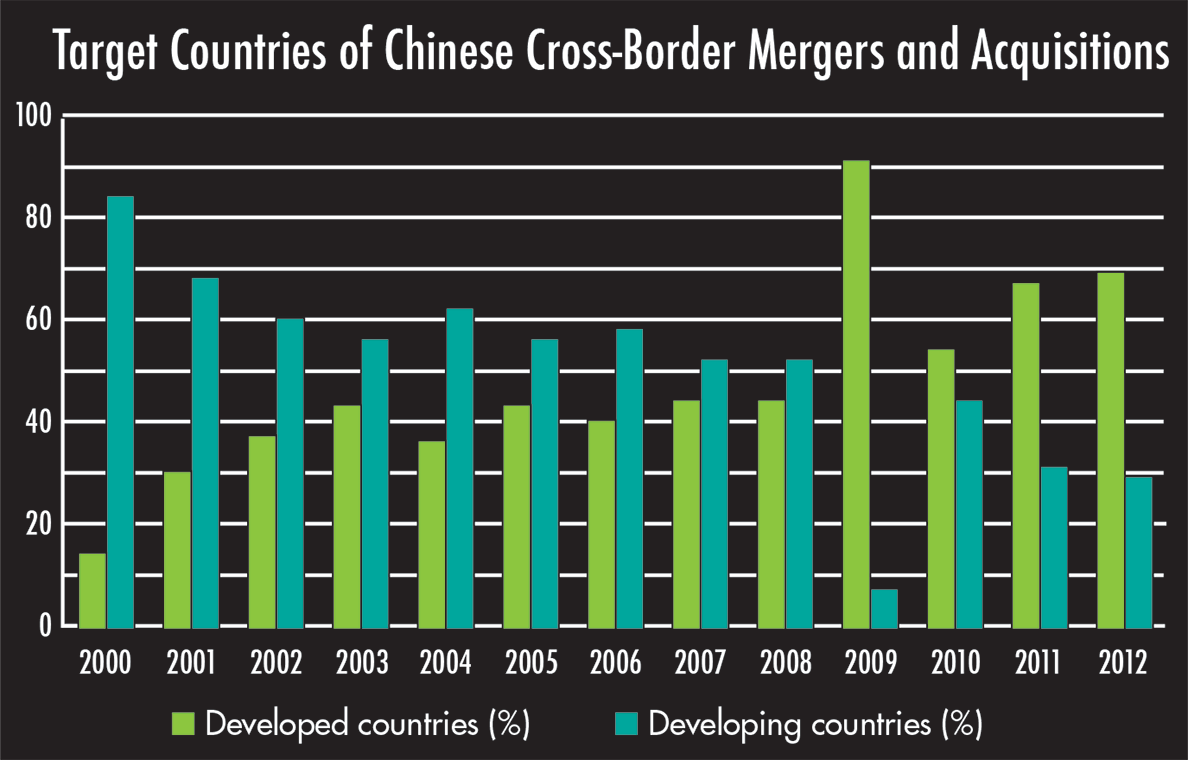

By analyzing a database of cross-border merger and acquisition activity from 2000 through 2012, Dr. Yang found that Chinese companies are looking to expand their market and also acquire strategic assets, including established brand names, human capital and research and development capability.

“They want the technology, the skills, the R&D knowledge,” not cost efficiencies, she says, noting that her work was funded by a provost’s grant. By contrast, “U.S. companies are looking for cheaper labor.”

Dr. Yang has found mixed profitability when analyzing results of cross-border M&A, possibly due to the government role in Chinese business. She also studied the pattern of Chinese firms copying each others’ merger activity, measuring how similar their strategies are and which companies are most successful.

One counter-intuitive finding: Chinese firms are more attracted to countries that have low government effectiveness, which companies in developed countries typically see as a risk factor. It could be that being from a developing country—many of which have low government effectiveness— Chinese companies are more comfortable in an environment similar to their home climate, or perhaps they’re hoping to avoid the national security concerns that have blocked acquisitions in countries with stronger, richer governments.

Monica Yang, Ph.D., has found some distinct trends in international merger and acquisition activity by Chinese companies. Source: SDC database.

For further information, please contact:

Todd Wilson

Strategic Communications Director

p – 516.237.8634

e – twilson@adelphi.edu